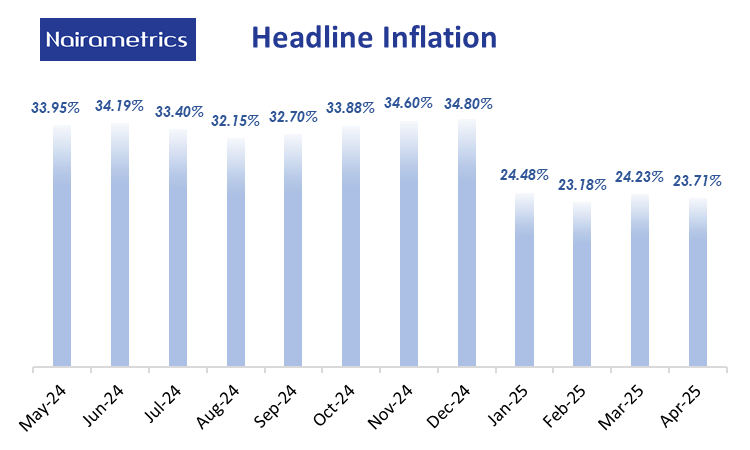

Nigeria Inflation. According to professional projections, Nigeria’s headline inflation rate is expected to average slightly in May 2025, following a marginal easing in April to 23.71%.

Analysts cite exchange rate stability, lower fuel prices, and slight food price relief in urban centers as the key drivers of this latent decline.

Market insights from Nairametrics Research, based on a May 2025 survey in Lagos, suggest the possibility of food inflation cooling.

The report observed price declines in select food items, suggesting that if the trend continues nationwide, food inflation could see further relief.

What analysts are saying

Head of Research at Afrinvest West Africa, Damilare Asimiyu, predicts headline inflation will ease to 23.5% in May, reflecting stability in the naira, which appreciated in the NAFEM window.

Additionally, a reduction in PMS pump price from N835 to N825/litre by Dangote Refinery is expected to lower business operating costs and boost household purchasing power.

Managing Director at Utica Capital Ltd, Mr. Kanabe Ayegbeni, echoing this sentiment, noted that “the inflationary trends in essential goods and services during May were quite stable,” a development he attributes to the effectiveness of ongoing government policies that have brought some macroeconomic stability.

However, Head of Research at Norrenberger, Samuel Oyekanmi, was optimistic but with a more cautious tone. While he expects a slight moderation in headline inflation due to the base effect and improved FX conditions, he warns that food inflation remains vulnerable.

“Headline Nigeria Inflation in May 2025 is expected to show a slight moderation, primarily due to base effects and relative stability in the exchange rate. The naira appreciated marginally, about 1%, during the month. Despite the expected tapering, food inflation may continue to face upward pressure due to structural challenges. Heightened insecurity and early onset of flooding in key food-producing regions, particularly the Middle Belt, have already begun to disrupt supply chains,” he said, citing a surge above 50% in food inflation in Benue State in April as a red flag.

Key drivers of May 2025 Nigeria Inflation

- Exchange rate stability: The naira recorded a slight appreciation in the NAFEM window during May 2025, strengthening by approximately 1.03% to N1,585.50/$ in the month. This marginal gain helped reduce the cost of imported goods, especially essential commodities like food, fuel additives, and industrial inputs.

- Fuel price cut: Reduced fuel prices translate to lower transportation and logistics costs for goods across the country. This, in turn, helps businesses cut operating expenses (OPEX), making room for stable or lower pricing of final products and supporting household consumption by limiting inflationary pass-through.

- Food price movements: In urban markets like Lagos and Abuja, there were modest reductions in the prices of essential food items, partly due to improved supply and ongoing government interventions.

- Base-year effect: High Nigeria Inflation in May 2024 helps moderate year-on-year comparisons. It is a technical softening, not necessarily a sharp improvement in purchasing power.

- Insecurity & weather shocks: Heightened insecurity in key food-producing states, including parts of the Middle Belt and Northwest, continues to disrupt farming and food transport. Additionally, the early onset of flooding in some agrarian areas has started to affect crop output. These structural issues have localized inflationary consequences, especially for fresh produce and grains, limiting the broader impact of macroeconomic gains and keeping food inflation stubbornly high in some states.

Looking ahead to June 2025

The inflation outlook for June remains cautiously optimistic, though not without significant downside risks. Sustained foreign exchange stability, steady food supply, and absence of new disruptions from insecurity or adverse weather conditions will be critical to maintaining the disinflation trend.

However, any shocks to energy prices, delayed effects of recent flooding in key farming areas, or further naira depreciation could quickly reverse these gains. Nigeria Inflation

GIPHY App Key not set. Please check settings